The power of strategic pricing with The Gene Team

In this case study, we reveal how listing a Murray Hill condo at $3,500 led to it being snapped up for $3,850 in just five days. With The Gene Team, we’re not just focused on getting tenants—we’re on a mission to maximize returns while making the market work for you. So, let’s dive into the surprising power of strategic pricing—and why sometimes, playing easy to get means getting exactly what you want.

The property

Located just two blocks from Trader Joe’s and a quick five-minute stroll to the East River ferry station, this condo is strategically placed in a highly desirable area. Did we mention the rooftop access with breathtaking city views? Perfect for those special events like the Fourth of July fireworks.

The pricing strategy

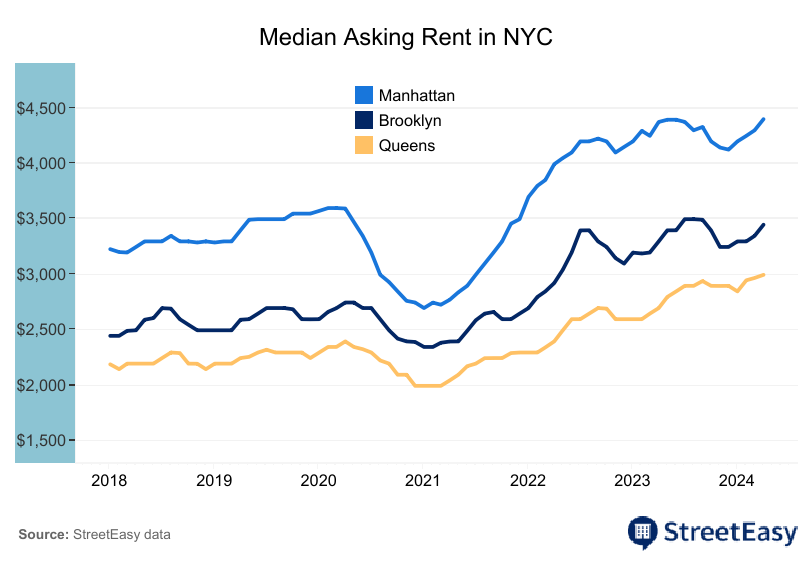

In a city that never sleeps, competition is fierce. By listing the condo below the median rent, we aimed to attract a flood of interest, leading to multiple offers and, ultimately, a higher rental price. This strategy isn’t just a shot in the dark—it’s backed by market dynamics.

According to a Bloomberg article from October 2023, NYC's real estate market has seen rising expenses outpace inflation, making savvy pricing strategies more important than ever.

The market conditions and data

According to data from Property Shark, there are a number of studios listed around the $4,000 mark, which have been available for more than 75 days. These overpriced studios will be on the market for some time, with possibilities of numerous offers below list price.

This further supports our strategy of underpricing to attract a higher number of interested tenants and create a competitive bidding environment.

The outcome and analysis

This case study effectively illustrates that underpricing, when done strategically, can attract more interest and lead to better financial outcomes. It's all about knowing your market and playing your cards right.

From setting the right price to crafting a compelling listing, our team is dedicated to ensuring that every property achieves its maximum potential. A report from Forbes in September 2018 emphasized that strategic pricing and professional guidance are critical in achieving optimal rental outcomes in such a competitive market—and that is perhaps more true in 2024.

The lesson: Don’t underestimate strategic underpricing in NYC property

None of this would have been possible without the expertise of a knowledgeable rental agent. The Gene Team’s deep understanding of the NYC property market and strategic approach were key to maximizing the rental yield. We don’t just list properties—we position them to win.